CSSF Licensing Explained: From Application to Operational Launch

A complete step-by-step guide to the CSSF licensing process for AIFMs and UCITS Management Companies in Luxembourg. Learn how the application works, key documentation required, substance expectations, approval timelines, and what firms must complete before going live.

CSSF Licensing Is Rigorous — But Highly Predictable

Luxembourg’s CSSF (Commission de Surveillance du Secteur Financier) is one of the most respected fund regulators in the world.

Its licensing process is:

- Transparent

- Structured

- Documentation-driven

- Substance-oriented

Unlike some jurisdictions where personal relationships play a larger role, Luxembourg places primary importance on:

- Governance

- Operational substance

- Risk management

- Internal controls

- Technology infrastructure

- Independence of functions

This guide explains the full CSSF licensing cycle, from the initial planning phase all the way to operational launch.

1. Who Needs CSSF Authorization?

The CSSF regulates:

A. Alternative Investment Fund Managers (AIFMs)

- Private equity managers

- Venture capital managers

- Real estate fund managers

- Debt and credit fund managers

- Infrastructure fund managers

- Hedge fund managers

B. UCITS Management Companies

- Retail and institutional liquid funds

- Multi-asset funds

- SICAV/umbrella UCITS structures

C. Investment Firms Providing MiFID Services

Some AIFMs and ManCos may also apply for limited MiFID permissions.

D. Specialized Fund Structures

CSSF supervises:

- SIF

- SICAR

- UCITS

- Specialized SICAV/SICAF

- RAIFs (indirectly through the AIFM)

2. CSSF Licensing Overview: The Four-Phase Process

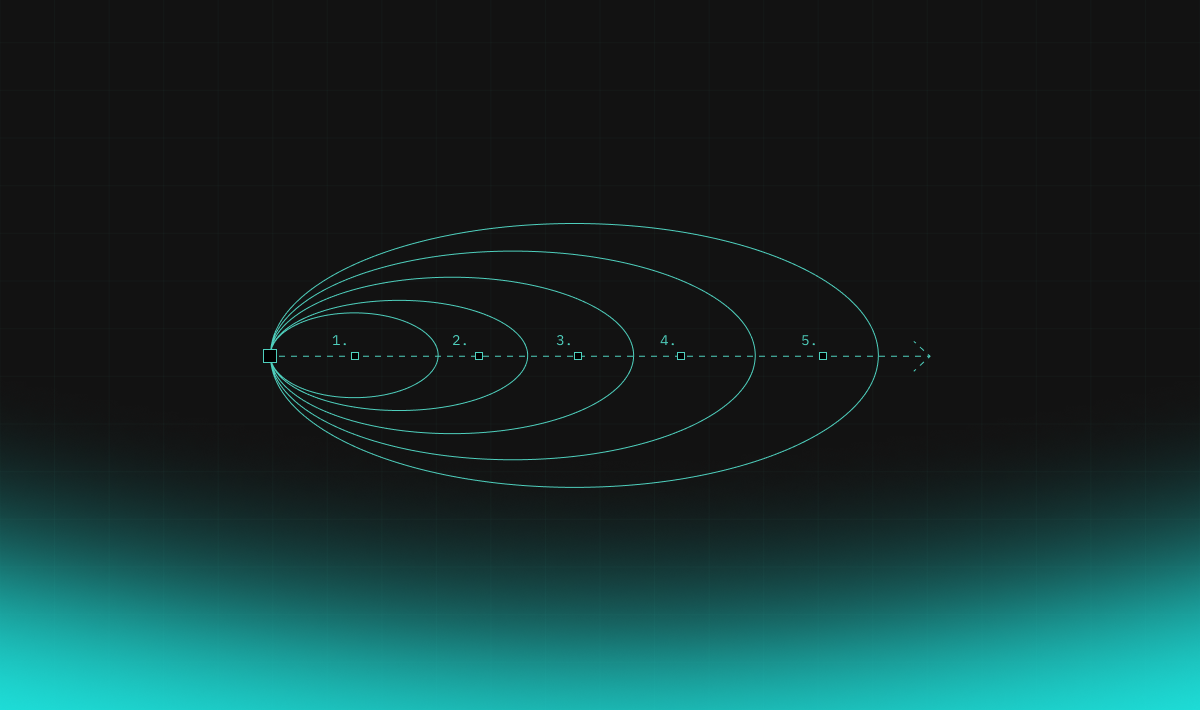

CSSF licensing occurs in four major stages:

- Pre-Application Planning

- Formal Application Submission

- CSSF Review & Approval Phase

- Operational Readiness & Go-Live

Let’s break these down in detail.

3. Stage 1: Pre-Application Planning

This phase is critical to avoid delays later.

3.1 Define Your Model

Identify:

- Fund strategies

- Target investors

- AUM projections

- Distribution model

- Substance footprint

- Risk & valuation approach

- Outsourcing vs in-house functions

3.2 Select Fund Structure

Common Luxembourg structures:

- RAIF

- SIF

- SICAR

- SICAV

- SCSp

3.3 Identify Key Persons

CSSF requires:

- Two Conducting Officers (in Luxembourg)

- Qualified Directors

- Risk management head (independent)

- Compliance/AML officer

- Portfolio management leadership

3.4 Initial Discussions With CSSF (Optional)

Many applicants schedule pre-filing consultations.

4. Stage 2: Formal Application Submission

The CSSF expects a comprehensive application dossier, typically 250–800 pages depending on complexity.

4.1 Regulatory Business Plan

Includes:

- Business model

- Strategy

- Risk management approach

- Liquidity risk approach

- Valuation methodology

- Governance structure

- Compliance model

- IT systems & data flows

- Outsourcing arrangements

- Internal controls

4.2 Policies & Procedures

Including:

- Risk Management Policy

- Compliance Manual

- AML/CFT Manual

- Conflicts of Interest Policy

- Outsourcing Policy

- Valuation Policy

- Remuneration Policy (AIFMD/UCITS aligned)

- Business Continuity Plan

- IT & Cybersecurity Policy

- Complaints Handling

- Internal Audit Charter

4.3 Substance Documentation

CSSF requires real presence in Luxembourg:

- Conducting officers located in Luxembourg

- Management body with Luxembourg representation

- Office lease or registered presence

- Independent internal control functions (risk, compliance)

4.4 Capital Requirements Evidence

For ManCos & AIFMs:

- €125,000 minimum capital

- Additional capital based on AUM for AIFMs

- PII insurance

4.5 Organizational Structure & Key Staff Files

Includes:

- CVs

- Fit & proper checks

- Personal questionnaires

- Organizational charts

- Segregation of duties

4.6 Fund Documents (If Applicable)

- Prospectus

- Offering memorandum

- KIID/KID

- Depositary agreement

- Administration agreement

5. Stage 3: CSSF Review & Approval Process

This phase is iterative and may involve several rounds of clarification.

5.1 CSSF Questions & Requests

Common areas of inquiry:

- Outsourcing oversight

- Independence of risk management

- Valuation methodology

- Remuneration alignment with AIFMD

- Fund strategy details

- Cybersecurity & IT governance

- Business continuity

- Conflicts of interest

- Board composition & experience

5.2 Meetings With CSSF

Usually involving:

- Conducting officers

- Risk management head

- Compliance head

- Directors

5.3 Approval Granted

Once satisfied that:

- Governance is strong

- Substance requirements are met

- Risk/compliance are independent

- IT & operational systems are in place

CSSF issues an authorization letter.

6. Stage 4: Post-Authorization Operational Readiness

Many firms underestimate this stage — but it is essential before managing assets.

CSSF expects:

- IT infrastructure fully deployed

- Risk management framework operational

- Portfolio management systems live

- Data aggregation from custodians/admins functioning

- Liquidity & risk calculations active

- Onboarding/KYC processes in place

- Annex IV reporting engine configured

- Document management system operational

- Compliance monitoring plan implemented

- Governance committees constituted

- Delegation monitoring in place

CSSF may conduct onsite inspection visits.

7. CSSF Licensing Timeline (Typical)

Stage

Duration

- Pre-Application | 1–3 months

- Application Review | 6–12 months

- Authorization Granted | Month 12

- Operational Setup | 1–3 months

- Go-Live | Month 13–15

Large AIFMs or UCITS ManCos may take longer.

8. Technology Infrastructure Required for CSSF Licensing & Operations

CSSF places strong emphasis on operational resilience and IT governance.

Required Tools

- Portfolio Management System (PMS)

- Data aggregation from custodians/fund admins

- Reconciliation engine

- NAV oversight tools

- Risk management system (market, liquidity, concentration)

- Annex IV reporting data engine

- Investor onboarding + AML

- Document vault & audit trail

- Fee engine (performance, management fees)

- Client/investor portal

- Compliance workflow engine

- Governance & committee logs

Firms must demonstrate full operational capability.

9. Why CSSF-Regulated Firms Choose Reluna

Reluna supports CSSF firms across all operational pillars.

Reluna provides:

- Portfolio management & analytics

- Multi-custodian data aggregation

- Full reconciliation

- Annex IV reporting data prep

- Investor onboarding + AML/KYC

- Document vault & audit trail

- Compliance tools & governance logs

- Fee & performance engine

- White-labeled investor portal

- Multi-fund / multi-entity support

Why this matters:

Luxembourg funds require:

- Strong governance

- Accurate data flows

- Robust risk monitoring

- Efficient oversight of delegates (PMs, admin, depositary)

Reluna enables ManCos and AIFMs to meet these expectations efficiently.

10. Common CSSF Licensing Mistakes to Avoid

- Treating Luxembourg as a “light-touch” jurisdiction

- Weak independence between PM & risk

- Insufficient Conducting Officer presence

- Poor IT governance documentation

- Missing liquidity risk framework

- No structure for Annex IV reporting

- Over-reliance on spreadsheets

11. Next Steps: Launch Your CSSF-Regulated Firm Successfully

CSSF licensing requires discipline, documentation, and strong operational foundations.

Reluna helps firms:

- Prepare operational infrastructure

- Build risk & compliance workflows

- Consolidate portfolio and fund data

- Achieve annex IV reporting readiness

- Manage multiple funds, strategies, & investors

👉 Request a Reluna demo to see how we support AIFMs and UCITS ManCos in Luxembourg from licensing through full-scale operations.